The world’s reliance on the U.S. dollar as the dominant reserve currency is often likened to an addiction. Central banks, governments, and financial institutions worldwide have continued to hold significant dollar reserves and conduct a substantial portion of global trade in dollars. But what makes this addiction so hard to kick? The prominence of the U.S. dollar began post-World War II with the Bretton Woods agreement in 1944. This pact established the dollar as the primary reserve currency linked to gold, while other currencies were pegged to the dollar. Although the gold link was severed in 1971, the dollar’s dominance continued to grow, fueled by trust in the U.S. economy and its robust financial system. Before the dollar, the British pound sterling held significant international importance. The rise and fall of currencies as the dominant force in international finance is not a new phenomenon. Such shifts often come with changing geopolitical power structures, major wars, or significant economic downturns.

The Bretton Woods agreement post-World War II solidified the dollar’s dominance, but history suggests that currency supremacy is never permanent.

A significant facet of the dollar’s dominance lies in the petrodollar system. Oil, a vital global commodity, is primarily traded in U.S. dollars. This system originated in the 1970s when oil-producing countries agreed to price oil in dollars. Consequently, countries needing to purchase oil must maintain substantial dollar reserves, further cementing its status. Global debt instruments are predominantly dollar-denominated. This reality means that both the borrowing nations and the investors have a vested interest in the dollar’s stability. A sudden move away from the dollar could trigger a financial crisis, with countries defaulting on their debts and investors facing massive losses. A decrease in dollar demand would have far-reaching consequences. Lower demand could lead to a weaker dollar, making imports more expensive for Americans and potentially leading to inflation. On the flip side, U.S. exports would become more competitive, possibly boosting the manufacturing sector. The balance of global economic power would inevitably shift as countries reorient their economic strategies.

The U.S. has historically been seen as a bastion of economic stability. Even during global crises, investors often flock to the dollar as a “safe haven”.

A vast majority of global transactions, especially in commodities like oil, are conducted in dollars, making it essential for countries to maintain sizable dollar reserves. U.S. financial markets, particularly the Treasury market, are among the world’s deepest and most liquid. This makes U.S. assets attractive to foreign investors and governments. Many countries have expressed the desire to diversify away from the dollar, citing concerns about potential U.S. sanctions, trade imbalances, and the desire for more autonomy in monetary policy. However, such endeavors haven’t been straightforward. A few reasons for the challenges include: While the euro, yuan, and gold have been proposed as potential alternatives, none have the same combination of trust, liquidity, and infrastructure as the dollar. Since so many transactions are already dollar-based, there’s a self-reinforcing loop where both buyers and sellers prefer to deal in dollars. Another strategy countries have employed to reduce dollar dependence is forming economic partnerships and entering into bilateral trade agreements wherein trade is conducted using local currencies. For instance, Russia and China have explored trading in rubles and yuan to bypass the dollar. Such initiatives, though commendable, are limited in scope and do not significantly diminish the world’s overall dollar dependence. But they do signify a growing desire among nations to seek alternatives and strengthen regional ties.

External asset and liability ratios to GDP across country groups, 1970-2020

(Source: Lane and Milesi-Ferretti, 2022)

The dominance of the dollar also carries significant geopolitical implications. U.S. monetary policy, for instance, can impact global liquidity and borrowing costs, even in countries with relatively low direct exposure to the U.S. economy. Moreover, the ability of the U.S. to enforce economic sanctions through the dollar-based global financial system is a potent tool in its diplomatic arsenal. Countries that go against U.S. interests may find themselves locked out of this system, resulting in dire economic consequences. Emerging markets have a particular affinity for the dollar, often borrowing heavily in the currency. This dollar-denominated debt poses risks, especially when local currencies weaken against the dollar. Repayments become more expensive in local currency terms, which can lead to financial crises in the borrowing countries. However, despite these risks, emerging markets find dollar-denominated assets attractive due to typically lower interest rates and the prestige associated with borrowing in a major global currency.

In recent years, the rise of digital currencies and financial technology has presented a potential challenge to the dollar’s dominance.

Cryptocurrencies like Bitcoin and Ethereum, though still nascent, represent a decentralized alternative to traditional fiat currencies. Furthermore, central banks, including China’s People’s Bank of China, are researching or rolling out their digital currencies, potentially offering an alternative to the SWIFT banking system, and by extension, a way to bypass the dollar in international trade. However, while technology presents a potential pathway to reduce reliance on the dollar, it’s still in the early stages. Trust, regulatory concerns, and infrastructure development remain significant hurdles.

The allure of the U.S. dollar isn’t merely economic; it’s deeply cultural and psychological. The dollar, being a symbol of the American dream, embodies notions of prosperity, opportunity, and freedom. These cultural and symbolic aspects play a crucial role in its international appeal, making nations and individuals gravitate towards it not just for financial security but also as a representation of aspiration. Countries stockpile U.S. dollar reserves primarily due to the currency’s stability. With the U.S. having one of the largest and most resilient economies in the world, the dollar offers a safety net during economic downturns. This inherent trust in the U.S. economy’s resilience makes moving away from the dollar a challenging proposition, even if countries wish to diversify their reserves.

The U.S. dollar’s disproportionate share in global assets and transactions

(Source: Committee on the Global Financial System, 2020)

While the Euro, Yen, and Yuan are often touted as potential rivals to the dollar, they come with their challenges. The Eurozone’s economic disparities, Japan’s prolonged economic stagnation, and China’s opacity in financial dealings hinder their potential to dethrone the dollar in the immediate future. However, their roles in the global economy are undeniably growing. Some experts suggest that instead of one dominant currency, the future might see a multipolar currency world where the dollar, Euro, Yuan, and others play significant roles, each dominant in its sphere of influence. This setup could provide a more balanced and resilient global financial system, reducing the risks associated with a single currency’s dominance.

This economic theory, proposed by economist Robert Triffin in the 1960s, highlights the inherent conflict of interest in having a national currency also serve as a global reserve currency.

For the world to have an adequate supply of dollars for international trade, the U.S. must run deficits, potentially jeopardizing the currency’s long-term stability. This paradox underscores the complexities of managing a currency that the world depends on. The U.S. benefits from the dollar’s dominance, often termed as the ‘exorbitant privilege’. This refers to the unique advantage the U.S. has in borrowing and spending since there’s always a demand for the dollar. However, it also means the U.S. bears the responsibility of ensuring global economic stability. Any missteps, whether through fiscal policy errors or geopolitical moves, can disrupt the global financial ecosystem.

Institutions like the International Monetary Fund (IMF) and World Bank, which predominantly use the dollar in their operations, play a pivotal role in the currency’s global standing. Any changes in their policies or the introduction of alternative currency baskets could herald shifts in global currency preferences. Several nations have tried to move away from the dollar in bilateral trade, opting for local currency swaps. While these attempts signal a desire to reduce dollar dependence, they are yet to make a substantial dent in its dominance. Such moves, however, indicate an evolving landscape where nations are exploring strategies to minimize potential vulnerabilities.

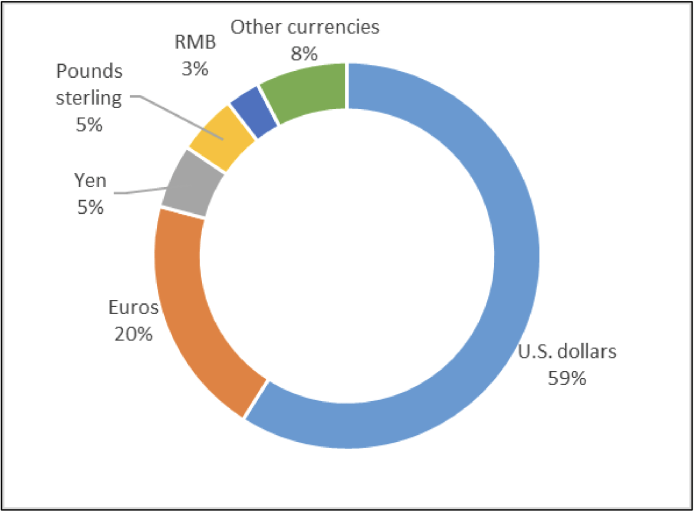

Central Bank Reserves, 2022

(Source: International Monetary Fund)

A strong dollar can lead to weaker local currencies for developing nations. When these countries need to purchase essential commodities priced in dollars, such as oil, a weak local currency means higher costs. Consequently, this can lead to imported inflation, negatively impacting the economic well-being of these nations. With the dollar as the benchmark, nations might engage in competitive devaluation of their currencies to boost exports. This often leads to ‘currency wars’, with nations attempting to outdo each other to achieve a favorable trade balance, potentially destabilizing global economic equilibrium. The uncertainties surrounding the dollar, combined with economic and geopolitical tensions, have occasionally boosted the appeal of gold and other assets perceived as ‘safe havens’. This dynamic serves as a barometer of global confidence (or lack thereof) in the dollar’s stability. While the thought of a multipolar currency world – where the dollar is one of several dominant currencies – may seem challenging, it could offer a more balanced and resilient global financial system. Such a system might be less susceptible to localized economic shocks and could provide nations with greater monetary autonomy.

Foreign Currency Balance Sheet of a Partially Dollarized Economy

(Source: National Bureau of Economic Research)

The world’s dependence on the dollar, both as a trade medium and a reserve currency, has been a defining feature of the post-World War II global economic order. While the advantages of this system have been evident, its vulnerabilities are increasingly coming to the fore. As nations navigate the uncertainties of the 21st century, from shifting geopolitical alliances to technological disruptions, the quest for alternatives to the dollar will intensify. Whether it’s through regional monetary agreements, diversification of reserves, or the embrace of digital currencies, the global financial architecture is poised for evolution. However, it’s crucial for nations and institutions to approach this transition with caution, ensuring stability while embracing change. Only through collaboration and a shared vision can the global community build a financial future that’s resilient, inclusive, and truly reflective of our interconnected world.